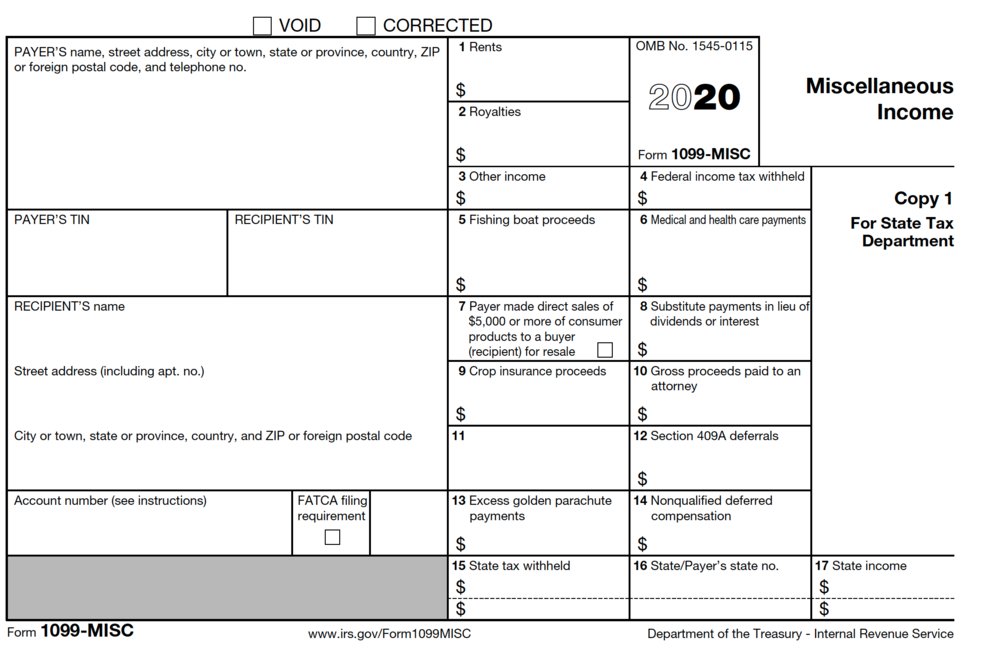

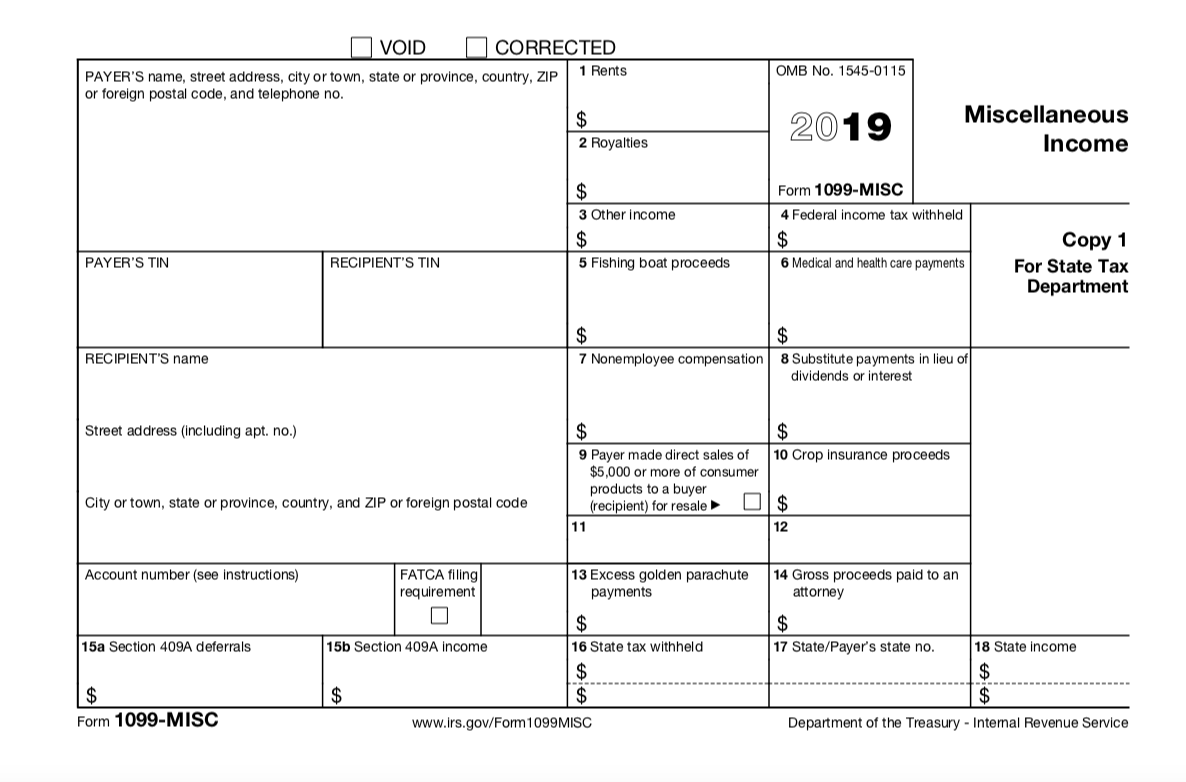

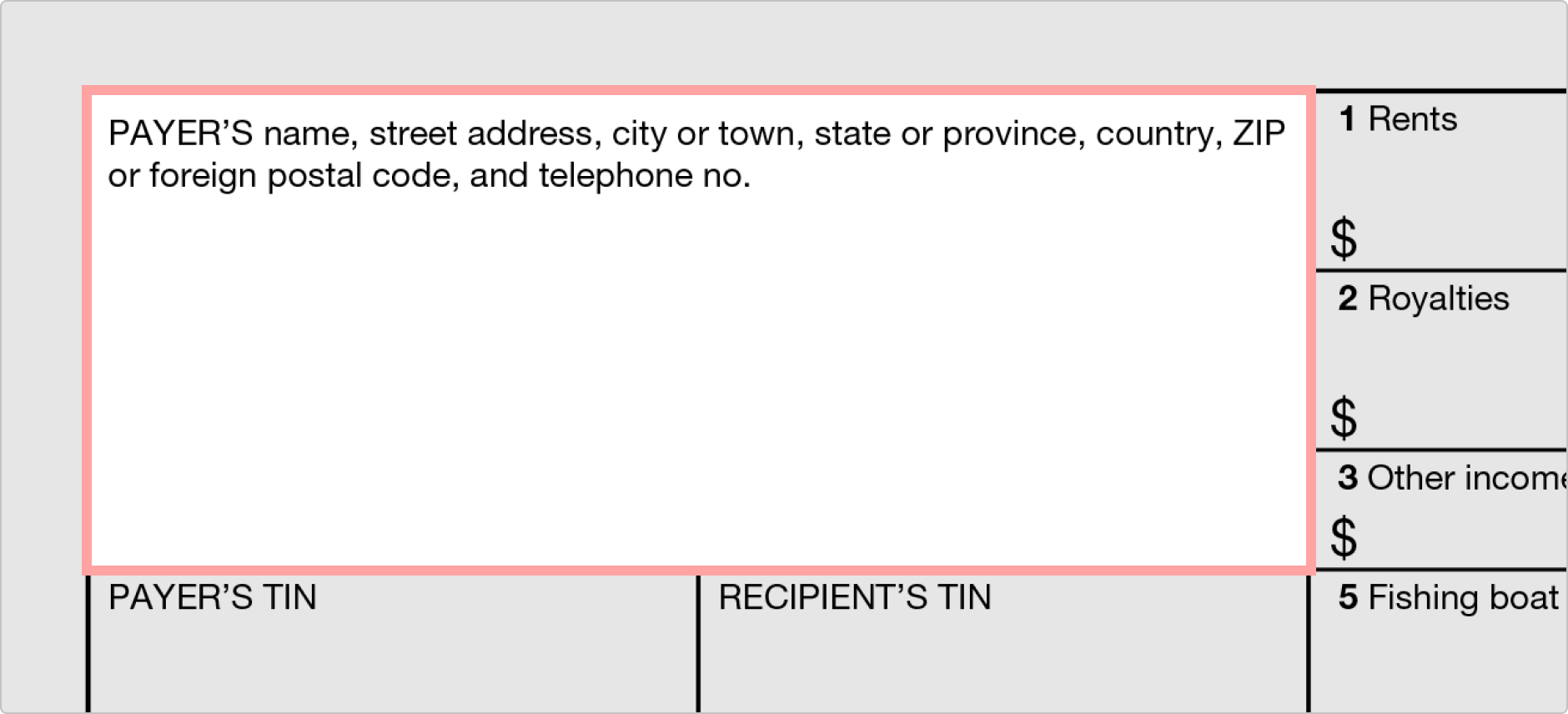

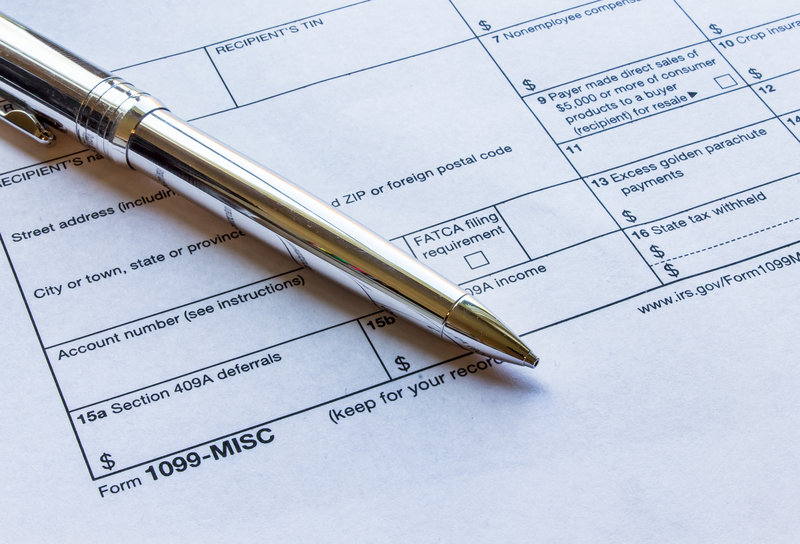

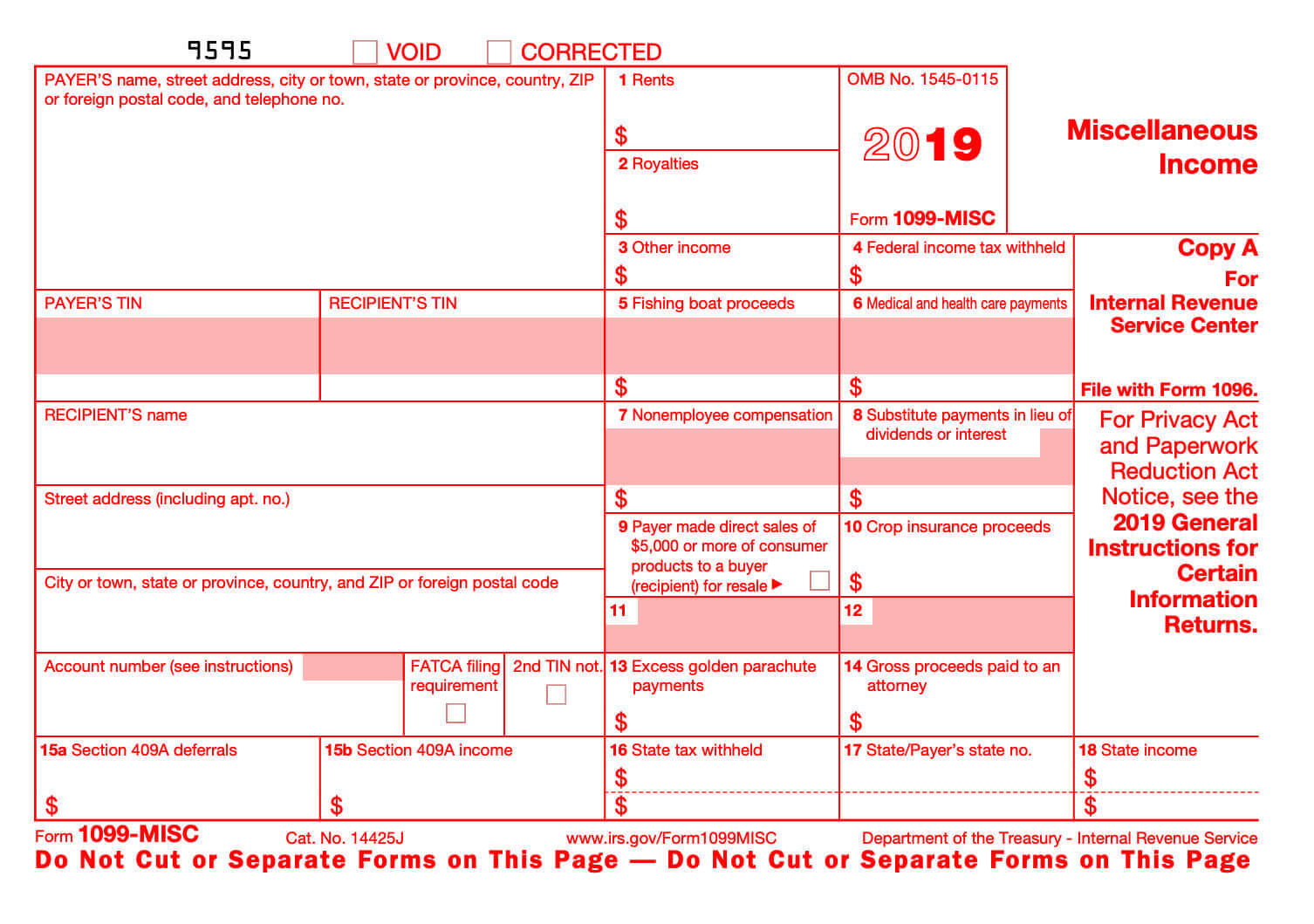

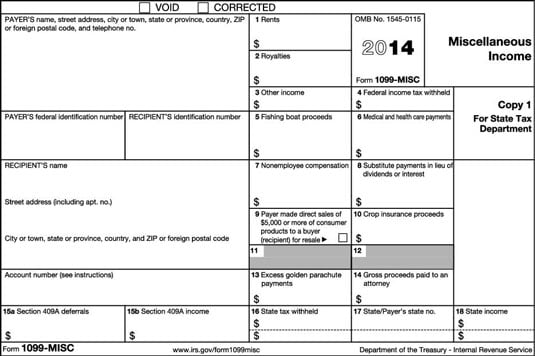

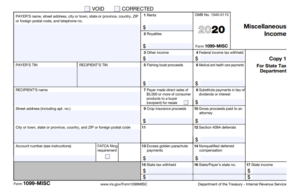

Form 1099 MISC is a tax form used by the IRS to track all the miscellaneous income paid to the nonemployees (independent contractor) in the course of the trade or business In a simple context, you must file 1099 MISC if you have paid any independent contractor a sum of $600 or more in a year for their services for your business or trade TheYou will get a 1099 form in the mail if you received certain types of income or payments (other than wages, salaries, or tips) during the year Generally, you will have to report the information from a 1099 on your tax return We have divided the topic of 1099 forms into three pages 25 Little Known 1099 Independent Contractor Deductions Don't sweat getting a form 1099MISC Here we will do a dive deep into tax deductions other than your typical office supplies To shed some light and make itemizations a little less "taxing," Keeper Tax has compiled a quick summary of deductions you might qualify for, and should be sure to take, in order to minimize your costs and maximize your success on your tax

Change To 1099 Form For Reporting Non Employee Compensation Ds B

Independent contractor form 1099 pdf

Independent contractor form 1099 pdf-1099 Form Independent Contractor Printable – A 1099 form reports certain kinds of income that tax payers have earned during the year A 1099 form is crucial because it's used to record nonemployment income earned by a taxpayer Whether it's cash dividends paid by a company that owns a stock or interest accrued from a bank account, a taxfree 1099 can be issued 1099 Form IndependentIt's another story for freelancers and independent contractors who have their income reported on Forms 1099 If you are earning Form 1099 income you need to know your income tax bracket because you do not have the benefit of employer withholding and must send estimated tax payments to the IRS each quarter If you pay too little in estimated taxes the IRS may subject you

15 Printable 1099 Form Independent Contractor Templates Fillable Samples In Pdf Word To Download Pdffiller

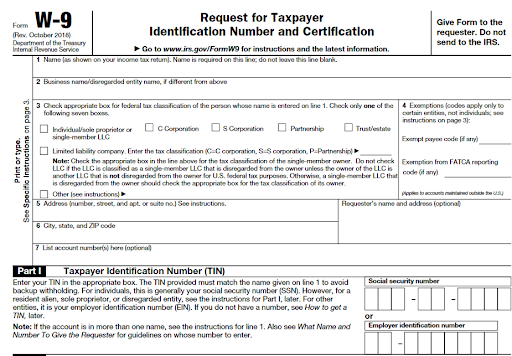

Any independent contractor can form an SMLLC to own and run a oneowner business Like a corporation, an SMLLC is a separate legal entity It can own property, open bank accounts, hire employees, borrow money, enter into contracts, sue and be sued, and do anything else in the business world that a human can do An independent contractor is selfemployed and receives 1099 forms from each client they did work for during the year An independent contractor fills out a W9 for their client For a sole proprietor, these 1099 forms (along with all the business expenses) flow onto Schedule C and then on to the 1040 You don't necessarily need to form a LLC to be an independent contractor The benefit of forming a LLC is that you will limit your liability as the name suggests Limited Liability Company Your liability is generally limited to what you put into the company, such as

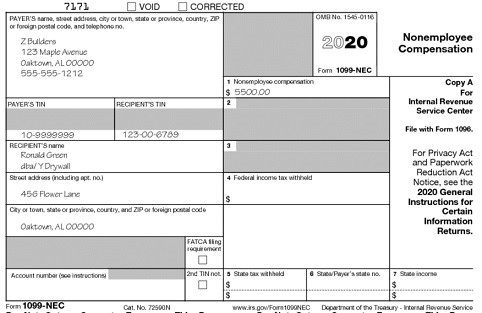

For example, if you give a worker a 1099 Form rather than a W2 Form, they may still be an employee Persons who work for you may qualify as employees under the law, even if, for example You have the person sign a statement claiming to be an independent contractor;If you are classified as an "independent contractor," you may be paid with a "1099" with no deductions made for taxes, unemployment, or other contributions that an employee pays Your terms of employment may have been decided by an agreement or contract, even if it is just verbal, or perhaps you have not even discussed the terms of your employment with your employerAn independent contractor receives this form (1099NEC) instead of the From W2 form when the payer doesn't consider you an employee, and therefore doesn't withhold any of the usual payroll taxes An exception to this is Box 4 on the 1099NEC form Namely, if you do not provide a TIN to the payer, they must backup withhold on certain payments

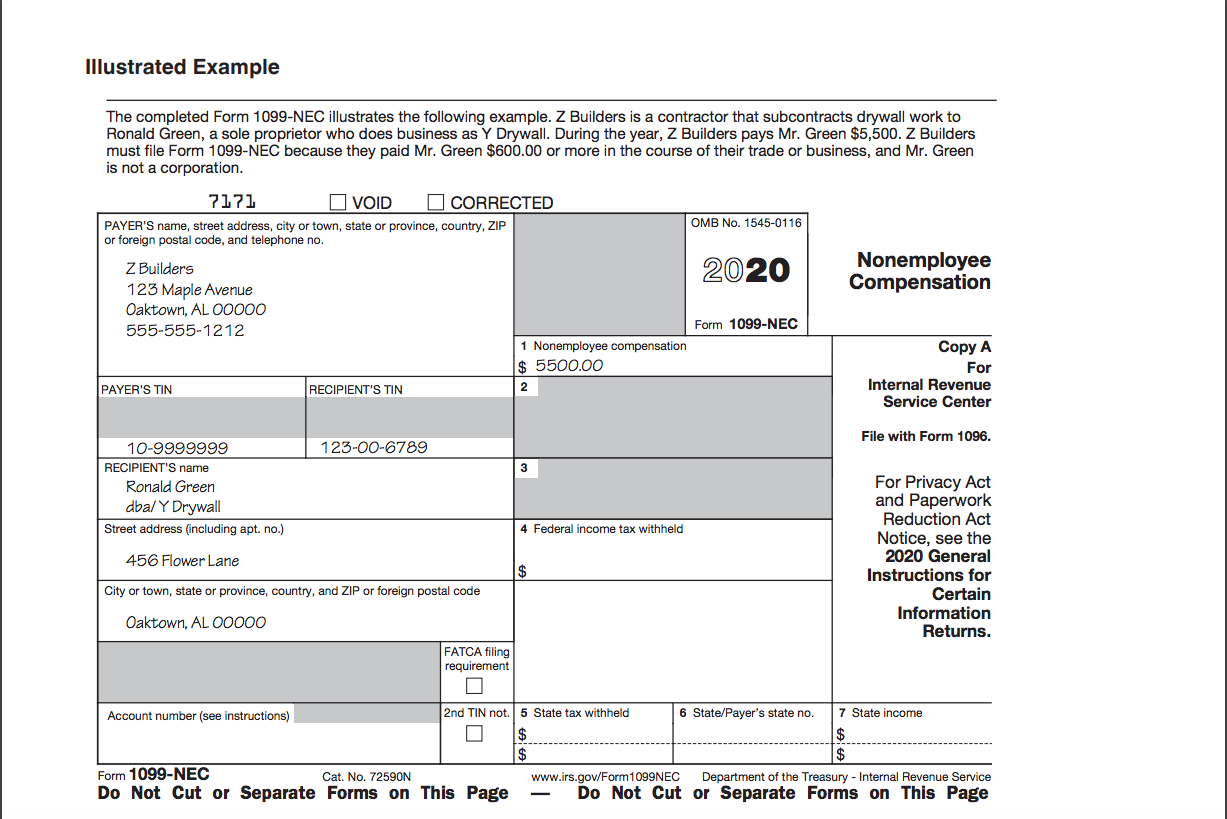

Rather, the business paying the independent contractor must maintain the form and use the data supplied to ensure that proper compensation is issued 2 IRS Tax Form 1099NEC As of the tax year, the IRS Form 1099NEC is the independent contractor tax form used by businesses to report payments to a contract worker in the previous tax yearIf an independent contractor earns more than $599 from a singlepayer, that payer is required to issue the contractor a 1099 form detailing their earnings for the year W9s and 1099s are tax forms that businesses need when working with independent contractors Form W9 is what an independent contractor fills out and provides to the employer Form 1099 has

When Is Tax Form 1099 Misc Due To Contractors Godaddy Blog

Paid Family And Medical Leave Exemption Requests Registration Contributions And Payments Mass Gov

Excel also offers a 1099 excel template to help new independent contractors or small business owners moving to digital expense tracking A software or an online app like QuickBooks, Intuit, or Zoho automatically collects and records data without employer or employees' intervention Generating pay stubs for 1099 independent contractors The 1099MISC form, also called the 1099 miscellaneous form or simply 1099 form, is an informational form that covers a broad range of payments over a specified period The form usually includes all of the extra earnings of an individual, aside from salary and wages, including prizes, royalties, awards, and a variety ofForm 1099 comes in various versions, depending on the payment type It can be required

Freelancers Meet The New Form 1099 Nec

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

_____ ("Independent Contractor") Independent Contractor is an independent contractor willing to provide certain skills and abilities to the Employer that the Employer has a demand and need In consideration of the mutual terms, conditions, and covenants hereinafter set forth, Employer and Independent Contractor agree as follows 1 WorkYou'll typically get your 1099 MISC in late January or early February The taxpayers are supposed to send 1099 MISC Forms to the contractors by February 1st, 21 Submit your Form 1099 online to the IRS by March 31st, 21 There are late penalties for payer's who file the information returns late As an independent contractor, you shouldGet Great Deals at Amazon Here http//amznto/2FLu8NwIRS Order Forms https//bitly/2kkMEkkHow to fill out 1099MISC Form Contract Work Nonemployee Compens

Independent Contractor 101 Bastian Accounting For Photographers

New 1099 Nec Form For Independent Contractors The Dancing Accountant

Form 1099NEC & Independent Contractors Category Small Business, SelfEmployed, Other Business How do you determine if a worker is an employee or an independent contractor?Covered under a selfelected workers' compensation insurance policy or obtain an Independent Contractor Exemption Certificate (ICEC) How to obtain an ICEC Read, complete, and submit the entire original and notarized application and waiver form with Independent contractors use a 1099 form, and employees use a W2 For W2 employees, all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer Contractors are responsible for paying their own payroll taxes and submitting them to the government on a quarterly basis

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Form 1099 K Wikipedia

Form 1099 is a type of information return; A 1099 is an "information filing form", used to report nonsalary income to the IRS for federal tax purposes There are variants of 1099s, but the most popular is the 1099NEC If you paid an independent contractor more than $600 in a financial year, you'll need to complete a 1099 While the income of workers is reported on Form W2 by their employer, independent contractors will collect Forms 1099MISC to report income to the IRS It is a common exchange between independent contractors and their customers To allow this to happen in the first place, the independent contractor must submit a Form W9 so that

How To File 1099 Misc For Independent Contractor Checkmark Blog

Why Caregivers Need A W 2 To File Taxes Not A 1099 Care Com Homepay

Independent Contractor Attestation It is possible for an Independent Contractor paid by 1099 Form to be considered eligible for your UnitedHealthcare group health plan It is your choice as the employer to consider these individuals to be eligible for coverage Should you choose to include If you work with independent contractors, you have to file a Form 1099MISC with the IRS at tax time Essentially, the 1099MISC is to contractors what the W2 is to employees It covers income amounts, while also indicating you haven't deducted any federal, state or other taxes 1099 contractor form If you weren't selfemployed, your employer would send you a W2 form that lists your income and all the deductions that were withheld from your pay throughout the year, including federal, state, Social Security and Medicare taxes As an independent contractor, you won't get a W2 with a tidy list of your income and deductions Instead, every

What Is A 1099 Employee The Definitive Guide To 1099 Status Supermoney

How To Pay Contractors And Freelancers Clockify Blog

In short, independent contractors you paid $600 or more to in a year qualify for the 1099NEC form Of course, the IRS likes to keep things complicated, so there are exceptions You don't need to file a 1099NEC for independent contractors if they are a C corporation or S corporation Form 1099NEC reports nonemployee compensation to independent contractors As of tax year , the 1099MISC is no longer used to report payments to contractors However, business owners need to understand when the 1099MISC form should be issued January 31st is usually the due date that your company needs to have sent the 1099 form to its recipient For edelivery, a company needs to have delivered the email to the recipient informing them that their form is ready Zenefits offers the option to prepare and store the 1099MISC for independent contractors

The Difference Between A W2 Employee And A 1099 Employee Ips Payroll

1099 Misc Form Reporting Requirements Chicago Accounting Company

You are required to report independent contractor information if you hire an independent contractor and the following statements all apply You are required to file a Form 1099MISC for the services performed by the independent contractor You pay the independent contractor $600 or more or enter into a contract for $600 or more Workers operating as independent contractors need to provide their own benefits and cover their expenses For tax purposes, the key thing to understand is the form that you receive If you are paid as an independent contractor, you will receive a Form 1099MISC, while if you are paid as an employee, you will receive a W2 form Independent Contractor Income compensation you receive for doing work or providing services as a selfemployed individual, not as an employee If you are selfemployed and an independent contractor, your compensation is reported on Form 1099MISC or Form 1099NEC (along with rents, royalties

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

How To File Taxes For 1099 Forms Independent Contractors

If so, you must fill out Form 1099MISC ("Miscellaneous Income") with the total amount you paid him or her during the year and the contractor information you obtained from Form W9They waive any rights as an employeeAnswer The determination can be complex and depends on the facts and circumstances of each case The

1

Independent Contractor 101 Bastian Accounting For Photographers

The contractor must complete IRS Form W9 Before the Independent Contractor Agreement is completed and signed the chosen freelancer must complete IRS Form W9 In addition to filing their usual personal tax return, independent contractors must file Form 1099 when they provide their annual declaration Tax forms for independent contractors Form 1099MISC Do you plan to pay your newly hired independent contractor $600 or more for his or her services, rents or other income payments?Fillable Form 1099MISC For Independent Contractor Form 1099 is one of several IRS tax forms (see the variants section) used in the United States to prepare and file an information return to report various types of income other than wages, salaries, and tips

Irs Form 1099 Reporting Audit Proofing Your Business Lorman Education Services

What Tax Forms Do I Need For An Independent Contractor Legal Io

Here, I walk you through applying for the Paycheck Protection Program (PPP) based on your gross income using Womply and their Fast Track application process1099MISC forms go to independent contractors, partnerships and other entities with whom you contract for services, among others The IRS has extensive guidance on Step 2 Fill out two 1099NEC forms (Copy A and B) Mark your calendar, because this form comes with a deadline In January, look at how much you've paid the independent contractor over the past year If you've paid them more than $600 within the past calendar year and their business entity is not an S corp or C corp, you'll need to file a

1

Know Which Irs Form To Use If You Paid Independent Contractors Small Business Trends

What is Form 1099 MISC?Independent Contractor Policy IC Form Instructions The IC Form must be completed and submitted to the UA Tax Office prior to an individual performing any services for which a fee payment is expected, including guest speakers (The IC Form is not required when paying "expense reimbursement only") Upon receipt of a completed IC Form, the An independent contractor is essentially a trained professional who works in their own time In basic terms, you are considered selfemployed You may be hired by someone to do a job, but how you go about completing the task is typically determined by you What Is a Ubiquitous Form 1099?

What Is A 1099 Form A Simple Breakdown Of The Irs Tax Form

/types-of-1099-forms-you-should-know-about-4155639-2020-83d4b735c1d64ecc93ba821369146618.png)

7 Key 1099 Forms You Need For Business Taxes

Hiring independent contractors This setup is widely spread across all company sizes Hiring contractors has multiple benefits the possibility to employ foreign workers or shortterm workers, cost per employee savings, and the ease of contractor relationships Although it's the easiest to set, it can lead to tax evasion charges and IRS audits when local laws and different setups forIn the simplest of terms, nurse practitioners that are 1099 employees are independent contractors They receive a different tax form than that which accompanies more traditional W2 employment status and are not technically employees of the company for which they work

An Employer S Guide To Filing Form 1099 Nec The Blueprint

1099 Misc Form Fillable Printable Download Free Instructions

1099 Misc Form Fillable Printable Download Free Instructions

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Understanding The 1099 Misc Form

A 21 Guide To Taxes For Independent Contractors The Blueprint

Your Ultimate Guide To 1099s

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png)

Fillable 1099 Misc Form Fill Online Download Free Zform

Printable 1099 Form 18 Brilliant 1099 Form Independent Contractor Models Form Ideas

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Ready For The 1099 Nec

Instant Form 1099 Generator Create 1099 Easily Form Pros

Tis The Season For W 2s And 1099s

Irs Changes Reporting Of Independent Contractor Payments Uhy

15 Printable 1099 Form Independent Contractor Templates Fillable Samples In Pdf Word To Download Pdffiller

W 9 Vs 1099 Understanding The Difference

Form 1099 Nec For Nonemployee Compensation H R Block

Irs Form 1099 Reporting For Small Business Owners In

1099 Forms Everything Businesses Contractors Must Know To Be Stress Free About Taxes

Independent Contractors Vs Employees Not As Simple As You Think New York Truckstop

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

Top 25 1099 Deductions For Independent Contractors

Introducing The New 1099 Nec For Reporting Nonemployee Compensation Asap Accounting Payroll

Who Are Independent Contractors And How Can I Get 1099s For Free

New Jersey Continues Its Push To End The Misclassification Of Employees As Independent Contractors Morea Law Llc An Employment Law Boutique

3

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

What Are Irs 1099 Forms

Managing The Ubiquitous Form 1099 Payroll Management Inc

Form 1099 Nec Form Pros

:max_bytes(150000):strip_icc()/FormW-94-d634d707ffee44839b5a46c998bd71aa.png)

What Is Irs Form W 9

What Is A 1099 Form Who S It For Debt Org

1099 Misc Form Fillable Printable Download Free Instructions

1

What Is The Account Number On A 1099 Misc Form Workful

What Is A 1099 Contractor With Pictures

What Is A 1099 Vs W 2 Employee Napkin Finance

Send Form 1099 To Independent Contractors By January 31st

Irs 1099 Misc Form Free Download Create Fill And Print Wondershare Pdfelement

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Hiring Guide For 1099 Independent Contractors Legalities Forms Taxes Exaktime

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

Do Llcs Get A 1099 During Tax Time

:max_bytes(150000):strip_icc()/1099div-23bffa1db9074ba1b43bdd2cb4ece3ec.jpg)

Form 1099 Definition

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Determining Who Gets A 1099 Misc Form And When It S Due

1099 Misc Form Fillable Printable Download Free Instructions

W 9 Vs 1099 Irs Forms Differences And When To Use Them

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

Issue Form 1099 Misc To Independent Contractors By 1 31 14 Kirsch Cpa Group Accounting Tax

1099 Form What Is It And How Does It Work Coverwallet

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements Hw Co Cpas Advisors

Where Is My 1099 Atbs

Change To 1099 Form For Reporting Non Employee Compensation Ds B

Form 1099 Nec Instructions And Tax Reporting Guide

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

What Is The Difference Between A W 2 And 1099 Aps Payroll

What Is Form 1099 Nec

Form 1099 Misc It S Your Yale

1099 Form Fileunemployment Org

New Irs Rules For 1099 Independent Contractors

Do I Need To File 1099s Deb Evans Tax Company

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Jan 31 Filing Deadline Remains For Employer Wage Statements Independent Contractor Forms Cozby Company

Understanding Taxes Tax Tutorial Payroll Taxes And Federal Income Tax Withholding

What Is The 1099 Form For Small Businesses A Quick Guide

Independent Contractor Cash Flow Planning For Life

What Is A 1099 Misc Form Financial Strategy Center

Producing 1099s For Vendors And Contractors Dummies

How To Prepare Form 1099 Nec When You Employ Independent Contractors Quickbooks

How To Fill Out A 1099 Misc Form

Nonemployee Compensation Form 1099 Due Dates Wichita Cpa Firm

Walk Through Filing Taxes As An Independent Contractor

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

10 Things You Should Know About 1099s

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

Diligent Recordkeeping Key To Surviving Tax Time For Self Employed Taxpayers Hackensack New Jersey Self Employed Tax Lawyer Samuel C Berger Pc

Independent Contractor 101 Bastian Accounting For Photographers

0 件のコメント:

コメントを投稿